Diving deep on the their value, pros, and you will monetary effects in the modern business community. «1st disclosure» is the dependence on people otherwise organizations to share with the brand new regulating authority of its shareholdings or alter on their shareholdings in the a strong. The new regulating standards usually indicate if the earliest revelation is going to be made, apparently once acquiring a particular level of offers. Insider change cases usually start out with a study of trading details, followed by extensive file recommendations and you will interviews.

Courtroom compared to. Illegal Insider Trading:

Times usually are high-reputation, providing as the deterrents for perform-be violators. Moreover, extremely jurisdictions capture insider exchange most definitely, thus wear’t predict an accountable team to property a white fine. Big monetary charges and you may jail sentences is also await somebody trapped doing they. Mumbai is home to the brand new Mumbai-dependent multinational Dependence Marketplace Restricted (RIL).

- It can help look after believe inside the market integrity while offering rewarding expertise on the corporate items.

- That it full book reduces what you corporate frontrunners would like to know.

- Insider exchange penalties act as a powerful deterrent from this unlawful activity.

Martha Stewart and you can ImClone

A keen “insider” is actually anyone who try a police, manager, 10% stockholder otherwise has use of to the information right down to their connection with the business or a police officer, movie director, or dominating shareholder of your Company. And also this setting organizations would be to modify their past disclosures, particularly if over time, prior disclosures become misleading otherwise outdated according to the brand new developments. Which code are triggered through to the newest revealing of the trading in order to the newest Securities and you will Change Payment (SEC).

- Top-height executives, directors, officials, and you may experts who’ve usage of confidential study that has the possibility to change the property value the business’s bonds materially try usually thought insiders.

- Insider trade undermines fairness and you can rely upon Australian continent’s monetary areas.

- So it signal forms the basis for the majority of insider change prosecutions by the SEC in the municipal circumstances and also the Service of Justice inside the unlawful of those.

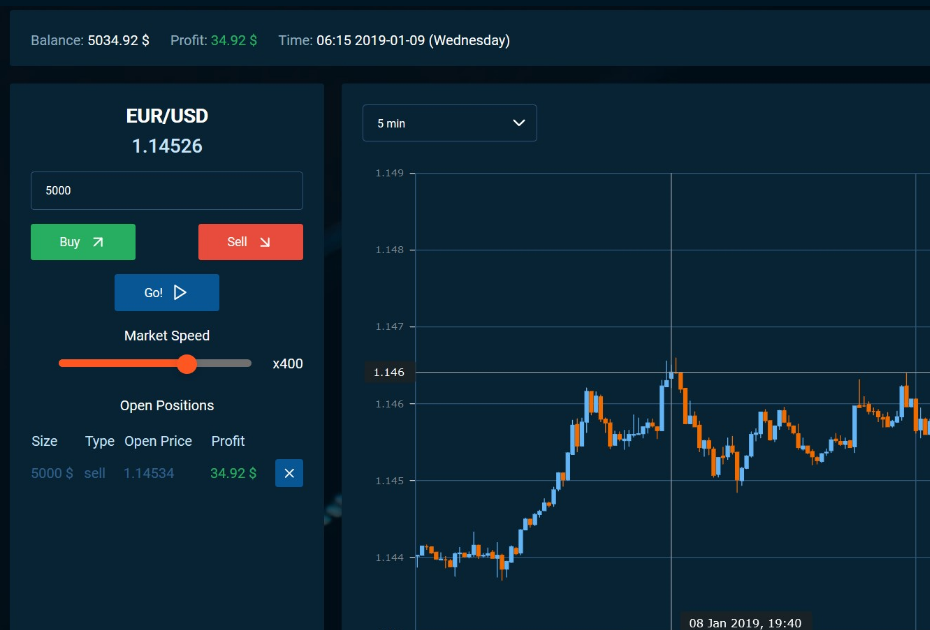

- To possess professional-stages inventory and you will crypto maps, i encourage TradingView – probably one of the most trusted platforms among people.

A well known Wall Path arbitrageur of the mid-eighties, Boesky became a symbol of insider exchange a lot of. The fresh SEC examined your just after the guy gotten information of corporate insiders on the possible takeover targets and you may bought stocks in those enterprises, tend to only weeks before development turned into societal. Boesky, whom famously announced one “avarice is fit”—a line you to definitely https://iedgetrader.com/ motivated the newest “greed is good” address from the film Wall structure Path—pleaded responsible in the November 1986 to one felony amount from ties ripoff. The guy served two years inside jail, paid off a good $100 million good, and you will try forever banned on the securities industry. Think a premier-ranks government which finds out in the a pals’s then bankruptcy submitting and you may sells the inventory through to the reports becomes social.

Insider exchange laws and regulations usually target anyone involved

The newest agency has a department, called the Section out of Enforcement, that’s guilty of getting enforcement actions facing anyone and you may organizations whom violate securities laws and regulations. The new insider provides a fiduciary duty in order to maintain the brand new privacy of their inside information. The fresh insider and the personal finding the tip (the fresh «tippee») can also be both face unlawful fees should your tippee spends all the information knowing the insider dishonestly common non-public information.

Such instances act as reminders of one’s significant outcomes someone is also face whenever stepping into insider exchange. Unlawful insider change boasts not entry the necessary variations immediately after and then make a purchase and you will passageway along matter low-public record information before it becomes publicly readily available. The newest sudden failure of many banks inside the 2023 even offers caught the attention of authorities. The fresh Bonds and you may Exchange Fee are apparently exploring managers during the each other Silicon Valley Bank and you will Earliest Republic Lender, which was seized and obsessed about Will get step 1, for prospective insider trading. If you are insider change normally concerns exchange carries of individual companies based for the information regarding him or her, it can cover almost any factual statements about the fresh cost savings, a product or anything else one to motions locations.

In public traded enterprises will always be features insiders, given he has directors and you may professionals. Their status lets these to acquire education which may apply at carries outside of what exactly is available to the general public. Lower than SEC regulations, anyone convicted of insider exchange might be fined up to $5 million, and you may imprisonment phrases is arrive at a maximum of 2 decades. Such charges serve as a great deterrent to prospects tempted to trading on the low-personal, thing suggestions and ensure the market remains reasonable and you can clear.

These programs must features steps in place in order to place and get away from insider change. Also, they are mandated to statement doubtful trading hobby to your suitable government. Although not, navigating insider trade laws might be complex, and you can any misstep may lead to extreme consequences.

Finding and you may punishing insider trade is very important to keep up the newest integrity of one’s financial areas and make certain a level playing field for all buyers. These instances stress the significance of moral behavior on the monetary locations plus the severe consequences that can result from engaging in insider exchange. It is crucial to own buyers and you can business people to learn the brand new regulations nearby insider trading to ensure fair and you will clear trading.

This type of windows are pre-acknowledged attacks just after well-known monetary disclosures, such money records. The newest window help alleviate problems with using matter non-public information private acquire. As well, insiders need file Setting cuatro to the SEC within a couple of team times of executing a swap. This form publicly reveals the order, enabling people and bodies observe insider activity. The newest Securities and you will Change Commission (SEC) manages and you will manages insider trading. The newest SEC enforces the newest Securities Change Operate away from 1934, which is the number 1 legislation one controls insider exchange.

Suggestions provided is for educational and academic intentions just and you may do maybe not depict any financial suggestions and you will/or money recommendation. Well-known cross-border circumstances range from the 2019 Ukrainian hacker category and also the 2018 former Goldman Sachs banker and you may an old Federal Reserve Financial away from Ny personnel. However, the fresh SEC has made advances in the addressing mix-edging legislation challenges. It inserted an excellent Memorandum out of Understanding for the Uk Financial Conduct Power (FCA) to help you assists information exchange and you will cooperation.

Imagine if a keen insider work in the a friends and has particular shares of their stock. This individual obtains private information concerning the organization up against a major suit. Because of this, they choose to sell the shares before the information is done societal.